Lady Becomes A Go-To Nanny Because She Has A Pool, Decides To Demolish It And Family Gets Riled Up

For homeowners blessed with a pool on their property, the concept of pool taxes is likely a familiar one. These encompass various taxes linked to the establishment, utilization, ongoing care, and maintenance of a swimming pool.

The ability to deduct pool taxes, encompassing installation and maintenance expenditures, from your overall tax liability is contingent upon a specific criterion: the pool’s sole purpose must be oriented towards treating or providing therapy for a medically recognized condition. Any recreational or entertainment use of the pool precludes its qualification as a tax-deductible entity.

Remarkably, the inclusion of a pool augments a property’s value and is regarded as a home enhancement in the context of tax considerations, even if it fails to meet the requisites of a medical home improvement expense. The central character of our narrative today is the proprietor of such a pool, yet her quest for tranquility and privacy has been disrupted due to the spontaneous visits of her extended family, drawn to her residence by the allure of the pool.

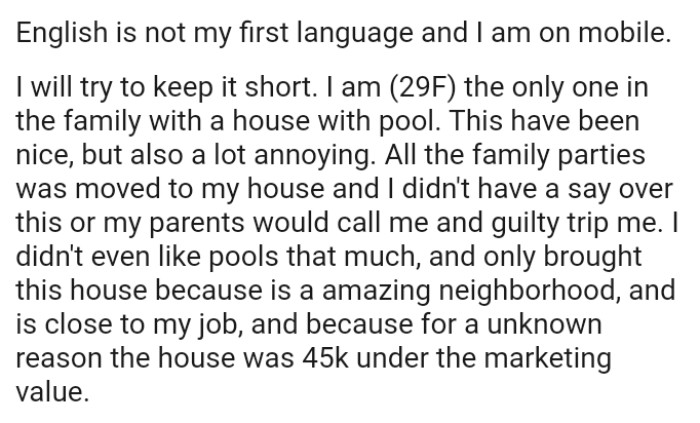

Intriguingly, within the family fold, the protagonist stands alone as the proprietor of a pool-equipped abode. Instances have transpired where her domain inadvertently transformed into a daycare center, with her becoming an involuntary babysitter for extended periods owing to the pool’s magnetic pull.

Faced with this situation, the protagonist opted to relinquish the pool. A survey of available properties within her current locale yielded less-than-compelling results. An exchange of words with a neighbor introduced an intriguing possibility: demolishing the pool and replacing it with an alternative feature.

This resolution, however, clashed with the expectations of her family, and the ensuing narrative provides a comprehensive account of the developments.

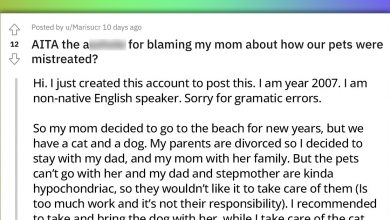

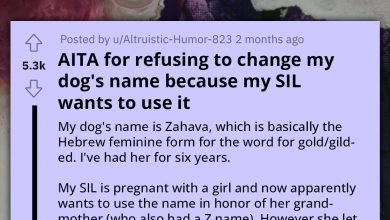

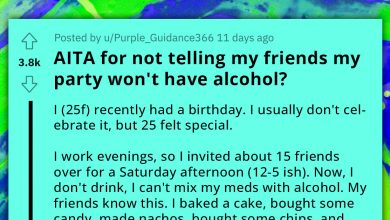

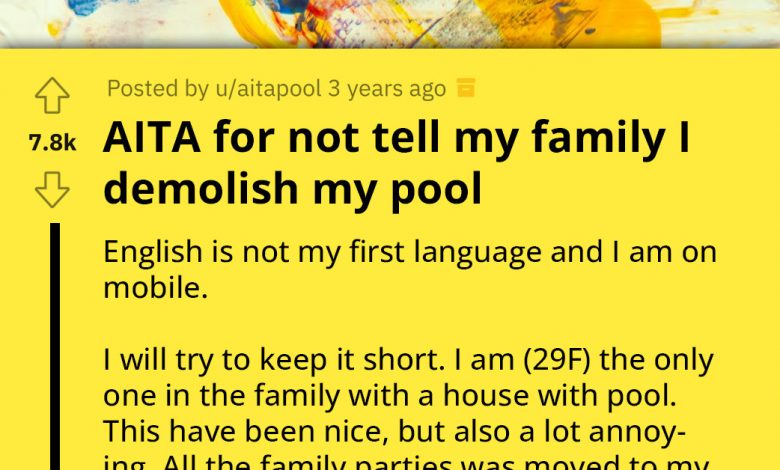

Headline reads:

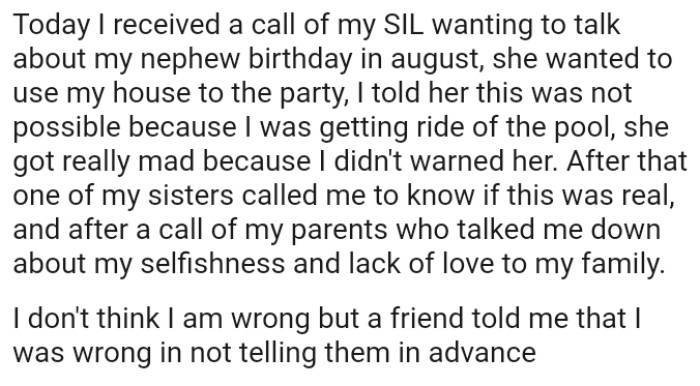

Family gatherings shifted to the protagonist’s residence without her input.

The protagonist’s house-hunting within her existing neighborhood proved uninspiring.

Conversations ensued, leading to the protagonist’s disclosure of her intention to eliminate the pool.

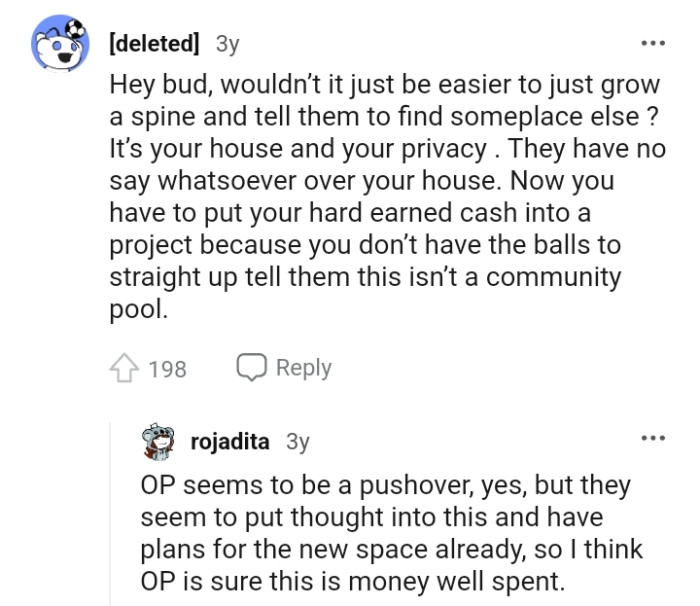

Venturing into the comments section reveals an array of Redditor perspectives on the protagonist’s predicament.

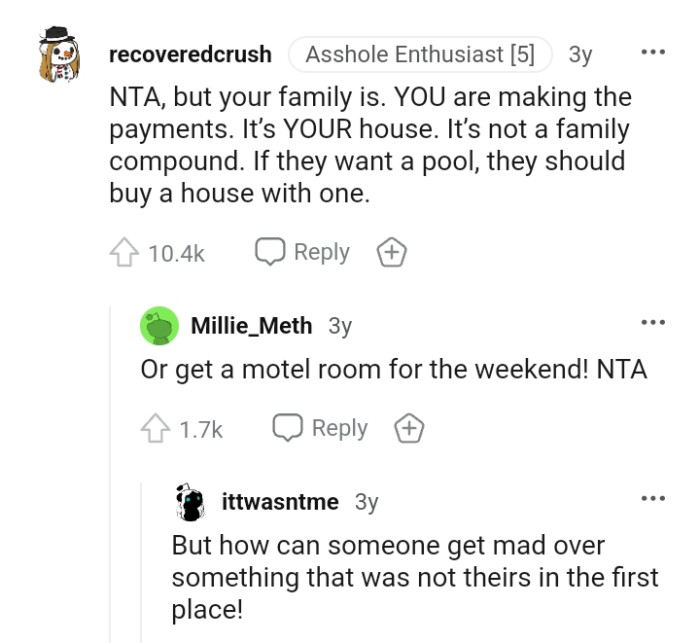

The family’s behavior draws criticism, with some asserting that they lack the right to be upset over the pool’s fate.

A fellow Redditor, a pool owner themselves, expresses fatigue over the financial burden of pool upkeep.

The consensus arises that the family’s conduct appears to disregard the protagonist’s domain and privacy.

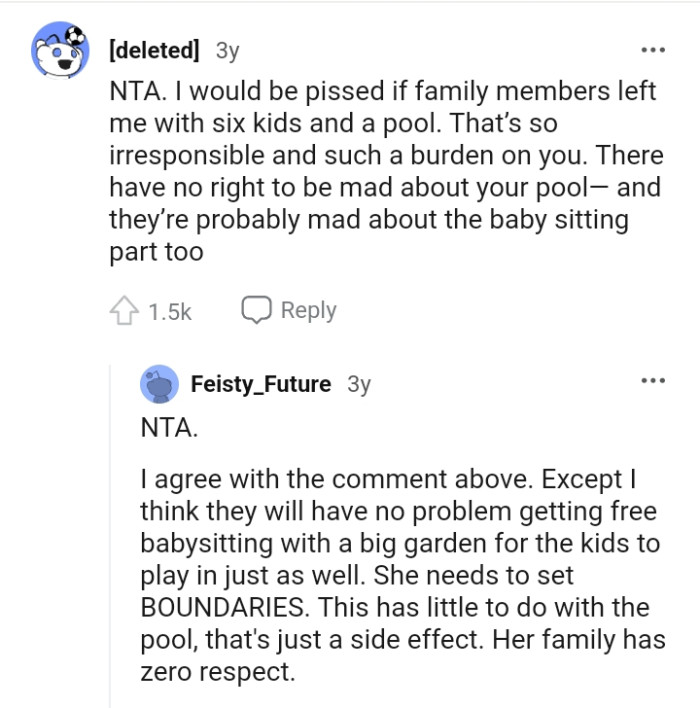

A redditor says:

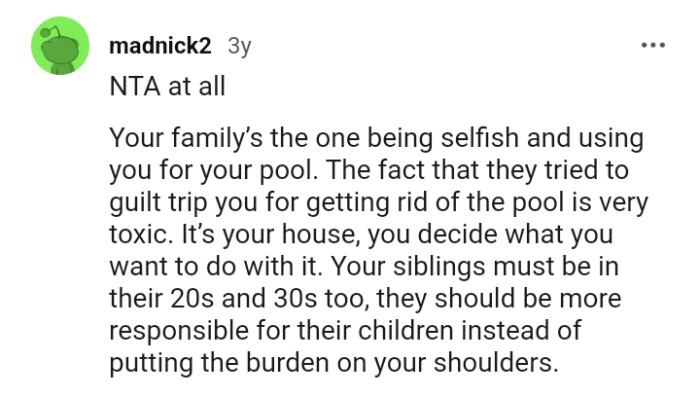

NTA at all

Your family’s the one being selfish and using you for your pool. The fact that they tried to guilt trip you for getting rid of the pool is very toxic. It’s your house, you decide what you want to do with it. Your siblings must be in their 20s and 30s too, they should be more responsible for their children instead of putting the burden on your shoulders.

The OP is not obligated to get anyone’s approval to remove her pool

They do not respect the OP’s home or her privacy

They have no say whatsoever about the OP’s home

They should be more responsible for their children instead of burdening the OP

It is important to note that while the expenses linked to operating, cleaning, and maintaining a pool may be deemed tax-deductible under specific circumstances, such was not the protagonist’s scenario. In addition to the financial aspect, the peace she sought was also disrupted, ultimately leading to the removal of the pool.

Redditors collectively support her choice, rendering her free from blame (NTA) for her decision. Your personal insights on this narrative are encouraged and welcomed in the comments section.