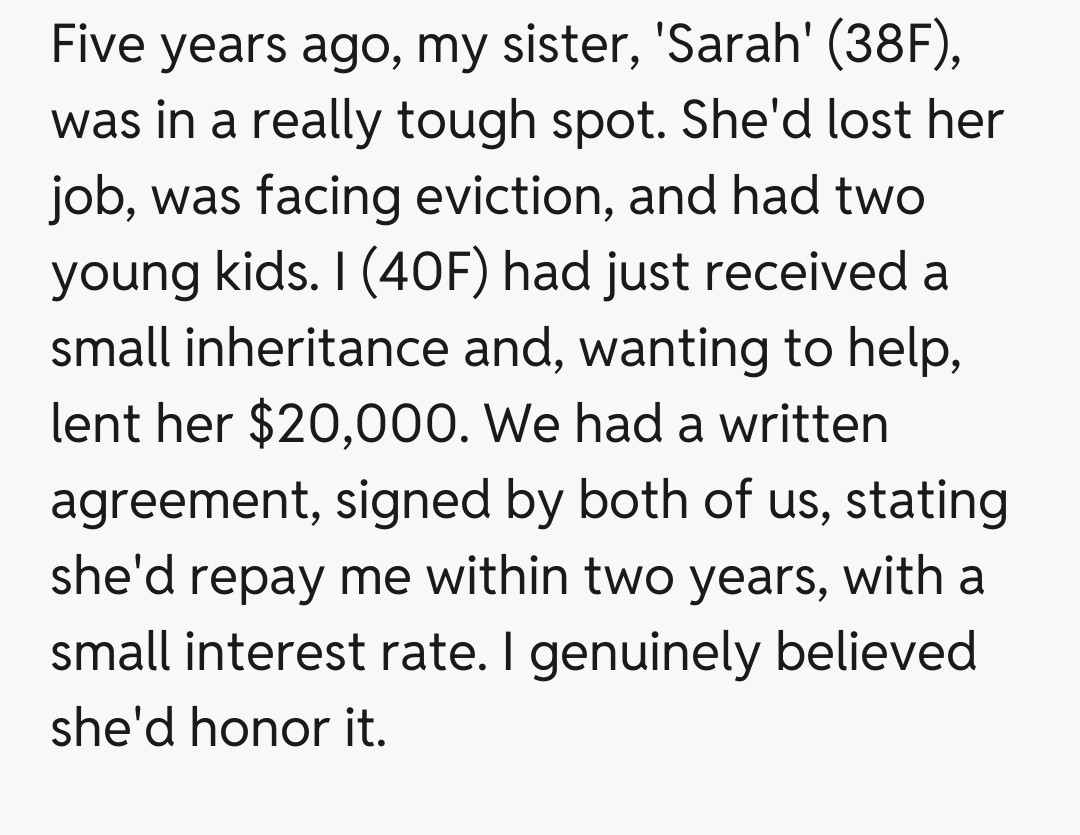

AITA for suing my sister (38F) for the money I lent her 5 years ago, even though she says I am ruining her new business?

Welcome back, dear readers, to another edition of 'Am I The A**hole?' where family dynamics often turn into financial fiascos. Today's story centers around a difficult situation involving siblings and a substantial loan that's gone unpaid for far too long. It's a classic tale of mixing money with family, and spoiler alert: it rarely ends well without clear boundaries.

Our OP (Original Poster) is facing a moral quandary: pursue a legal claim against her sister for a five-year-old debt, or let it slide, potentially sacrificing her own financial well-being for family harmony. The twist? The sister is now claiming the lawsuit is actively sabotaging her brand-new business venture. Talk about high stakes!

"AITA for suing my sister (38F) for the money I lent her 5 years ago, even though she says I am ruining her new business?"

This situation truly highlights the age-old dilemma of lending money to family. On one hand, OP acted out of genuine familial love and support, providing a significant sum when her sister was in dire straits. The existence of a written agreement underscores the expectation of repayment, moving it beyond a mere gesture of generosity. OP's patience for five years, despite her own financial needs, also speaks volumes.

However, Sarah's perspective isn't entirely without a nuanced layer. Starting a new business is incredibly stressful and capital-intensive. It's plausible that all her available funds are tied up in inventory, rent, and initial marketing, leaving little liquid cash. A lawsuit at this critical juncture could indeed cripple her nascent venture, potentially leading to its collapse and making repayment even more impossible.

The timing of the lawsuit, while legally pragmatic due to the statute of limitations, is undoubtedly challenging for Sarah. While OP has a right to her money, the emotional fallout within the family is immense. Sarah might feel cornered, perceiving the legal action as an attack rather than a last resort for a valid debt. This emotional component often trumps logical arguments in family disputes.

Ultimately, both parties are in difficult positions. OP is entirely justified in wanting her money back, especially with a written agreement. Sarah, while obligated, faces the immediate threat of her dream collapsing. The parents' intervention, while well-intentioned, often complicates matters by advocating for harmony over fairness, putting immense pressure on the person seeking what's owed.

The Internet Weighs In: Family Debts and Business Bets – Who's Really the A-hole?

Unsurprisingly, the comment section exploded with strong opinions on this one! The overwhelming sentiment leans towards NTA for OP, with many users emphasizing the importance of respecting loan agreements, regardless of family ties. Several pointed out that Sarah's ability to start a business while ignoring a substantial debt is a major red flag, suggesting a pattern of irresponsibility rather than genuine hardship.

While the NTA verdict is strong, a few YTA or ESH comments emerged, primarily focusing on the timing. These users argued that while OP has every right to the money, initiating a lawsuit during the fragile launch phase of a business could be seen as unnecessarily vindictive and counterproductive, potentially destroying any chance of repayment down the line. It's a tough call, highlighting the messy reality of such situations.

This AITA story serves as a stark reminder of the perils of lending money to loved ones without clear, enforceable terms and a strong understanding of potential outcomes. While OP's actions are legally sound and emotionally justifiable, the cost to family relationships is undeniable. It's a deeply personal decision whether to prioritize financial recovery over familial harmony, but one thing is clear: the path to getting your money back often involves navigating a minefield of guilt and resentment.