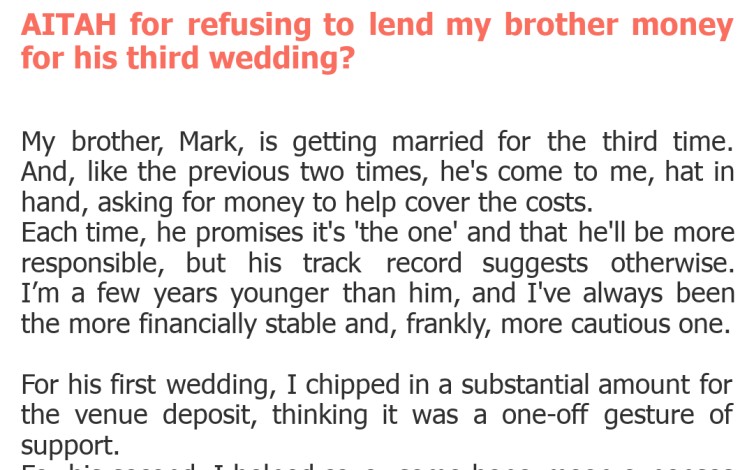

AITAH for refusing to lend my brother money for his third wedding?

Oh boy, do we have a doozy for you today! When it comes to family and finances, things can get incredibly messy, and our OP (Original Poster) is neck-deep in a sibling money saga. It's one thing to help out a loved one in a pinch, but what happens when that 'pinch' becomes a recurring theme, especially for celebratory, rather than emergency, occasions? Get ready for a tale of brotherly love, or perhaps, brotherly financial burden.

This week's AITA post dives into the sticky situation of a sibling being asked to fund a significant life event – not for the first time, but for the *third* time. Our OP is grappling with the emotional weight of saying no to family, particularly when it involves something as significant as a wedding. Is it a noble act of self-preservation, or a heartless refusal to support a loved one? Let's unpack this complex family drama together.

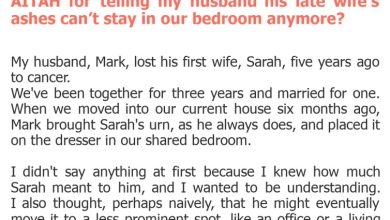

"AITAH for refusing to lend my brother money for his third wedding?"

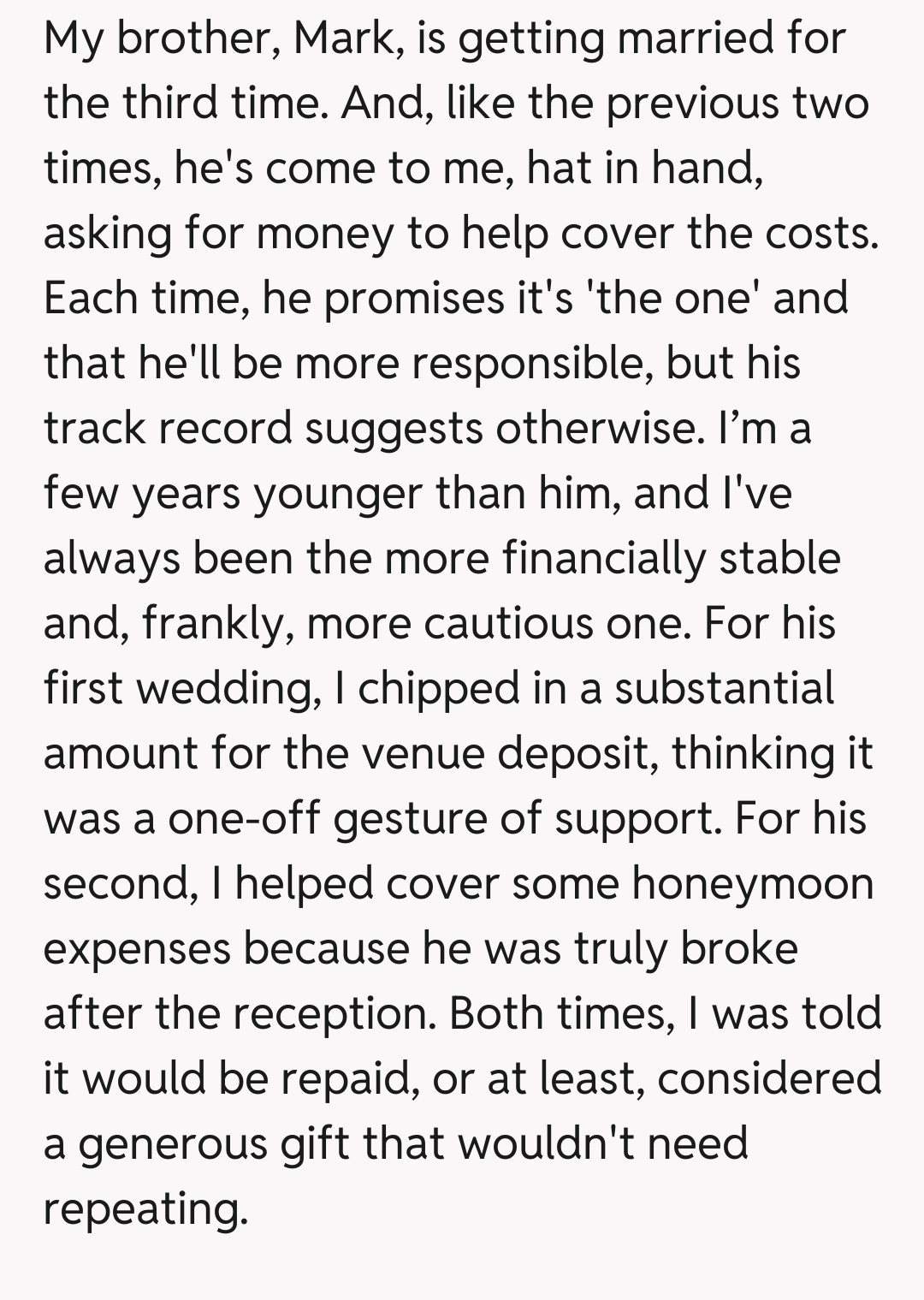

This AITA post perfectly encapsulates the dilemma many face when family and finances intertwine, especially when there's a history of financial irresponsibility. On one hand, there's the societal expectation of helping family, particularly a sibling. The desire to see a loved one happy, even if their choices are questionable, is a powerful motivator. OP's brother, Mark, likely feels entitled to this support given previous instances.

However, a crucial element here is the pattern of behavior. Mark is on his third wedding, and has previously relied on OP for financial assistance for his prior two. This isn't a one-time emergency; it's a recurring request for discretionary spending. OP's hard-earned savings are for a specific, important life goal (a house), which directly contrasts with Mark's seemingly lavish and impulsive spending habits.

Family pressure, particularly from a parent, adds another layer of complexity. The 'family helps family' mantra can be incredibly difficult to resist, making OP feel guilty for prioritizing their own financial stability. It's important to differentiate between genuine need and funding someone else's lifestyle choices, especially when it jeopardizes one's own future.

Ultimately, setting boundaries, even with family, is essential for financial health and personal well-being. While it might sting in the short term, refusing to enable a pattern of dependency can be an act of self-respect. OP needs to consider whether continued financial assistance truly 'helps' Mark in the long run, or simply reinforces his lack of fiscal accountability.

The internet weighs in: Is 'family' a blank check?

The comment section on this post was, predictably, a fiery debate. Many users overwhelmingly sided with OP, highlighting the importance of financial boundaries and personal responsibility. There was a strong consensus that 'family' doesn't equate to being an ATM, especially when the funds are for luxury items like a third wedding, rather than a genuine crisis. Users repeatedly emphasized that OP's savings for a house take precedence.

A smaller, but vocal, contingent argued that OP should help his brother, citing the importance of family ties. These commenters often suggested that OP could afford it, or that a 'loan' is different from a 'gift.' However, these opinions were often met with counter-arguments pointing to Mark's track record of not repaying and the clear pattern of dependency.

This AITA post serves as a stark reminder that saying 'no' to family can be incredibly difficult, yet utterly necessary for one's own well-being. OP's situation highlights the vital distinction between helping a loved one in genuine need and enabling a pattern of financial irresponsibility. While family bonds are important, they shouldn't come at the cost of your future. Setting clear boundaries, even when met with resistance, is a courageous act of self-preservation. Remember, you can't pour from an empty cup, especially when that cup is being drained by someone else's repeated choices.