AITA for telling my parents their plan to downsize and gift us nothing is selfish?

Oh, the age-old dilemma of family finances and generational expectations! This week's AITA case dives headfirst into that often-treacherous territory. We have an OP who feels their parents' recent financial decision, specifically regarding their assets and future inheritance, is nothing short of selfish. It's a tale that many adult children and even more parents can likely relate to, sparking conversations about what we owe our children versus what we owe ourselves in retirement. Get ready for a heated debate on entitlement and responsibility!

It's a delicate balance, isn't it? On one hand, parents spend decades raising and supporting their kids, often sacrificing their own financial comforts. On the other, adult children often face rising costs of living and sometimes hope for a boost from their parents, whether through gifts or future inheritance. When those expectations clash, as they seem to have in this story, the emotional fallout can be significant. Let's unpack the situation and see where our community lands on this contentious issue.

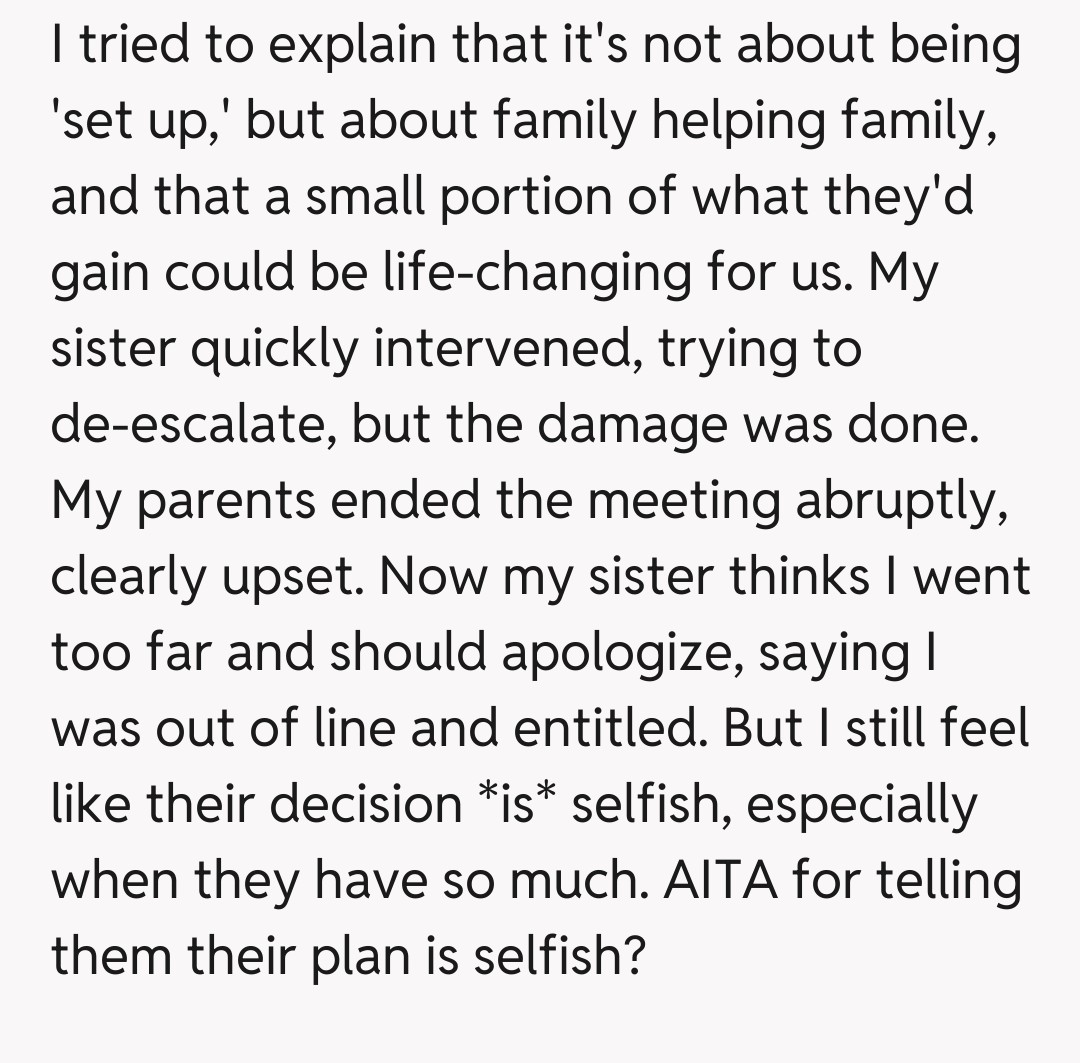

"AITA for telling my parents their plan to downsize and gift us nothing is selfish?"

This story hits a nerve for so many, touching on the complex interplay of family, money, and expectations. On one hand, parents work hard their entire lives, often making sacrifices to raise their children. The idea that they should then, in their retirement, be obligated to hand over their accumulated wealth to adult children, rather than enjoying it themselves, is a perspective many would find unreasonable. Their money, their rules, right? They've already fulfilled their parental duties by raising and supporting their kids into adulthood, providing a foundation.

However, it's also understandable why an adult child, especially one facing significant financial pressures like mortgages and childcare, might feel a sense of disappointment or even abandonment. There's a societal narrative, often unspoken, that parents will help their children when they can, and that inheritance is a natural progression. When a substantial sum appears to be within reach and then explicitly withdrawn from that expectation, it can feel like a missed opportunity or even a slight, especially if the children are genuinely struggling while the parents plan for luxuries.

The emotional response of OP, while perhaps poorly communicated, stems from a place of perceived need and a feeling of fairness within the family unit. To them, seeing parents allocate significant funds to 'nice cars' and extensive travel, while their children are stretched thin, creates a stark contrast that feels inequitable. It's not necessarily about entitlement in a malicious sense, but rather a different view on resource allocation within a close family and what familial support entails beyond childhood.

Ultimately, this is a clash of values and expectations. Parents have a right to their money, and children have a right to feel their feelings, even if those feelings aren't always productive. The key here is often communication, which clearly broke down. Was the parents' announcement insensitive in its delivery? Was OP's reaction overly aggressive? Both sides could argue their position strongly, highlighting the very human elements of money and family relationships.

The Internet Weighs In: Who's Really Selfish?

The comments section for this one was absolutely buzzing, as expected! Many users sided strongly with the parents, emphasizing that parental money is not an inheritance fund for adult children to claim. Phrases like 'They earned it, they spend it!' and 'Your parents are not your retirement plan' were ubiquitous. There was a strong sentiment that OP's reaction was entitled and ungrateful, highlighting that parents have already provided years of support and have every right to enjoy their golden years without guilt.

However, a significant portion of commenters also expressed empathy for OP, pointing out the difficult economic climate for young families today compared to previous generations. Some argued that while parents aren't obligated, it's a 'nice' thing to do if they have the means, and that the parents' explicit declaration felt a bit cold. A few even suggested that while OP's delivery was poor, the underlying feeling wasn't entirely wrong, sparking debates about the societal contract between generations. This shows the nuanced nature of family finances.

What a rollercoaster of emotions this story presents! It truly highlights the ongoing tension between parental autonomy and adult children's expectations. While there's no legal obligation for parents to provide financial assistance to adult children, the emotional landscape of family dynamics often creates unwritten rules and unspoken hopes. This situation is a harsh reminder that clear, respectful communication about finances, even when difficult, is crucial to preserving family relationships. Hopefully, OP and their parents can find a way to mend fences and understand each other's perspectives without further damage.